How to create Input Tax Report

This section explains how to create Input Tax Report documents.

The Input Tax Report is a report document that the operator has recorded the details of VAT transactions from the document recording expenses arising from purchases each month. This is a report that must be done every month.

See more How to create expanse note.

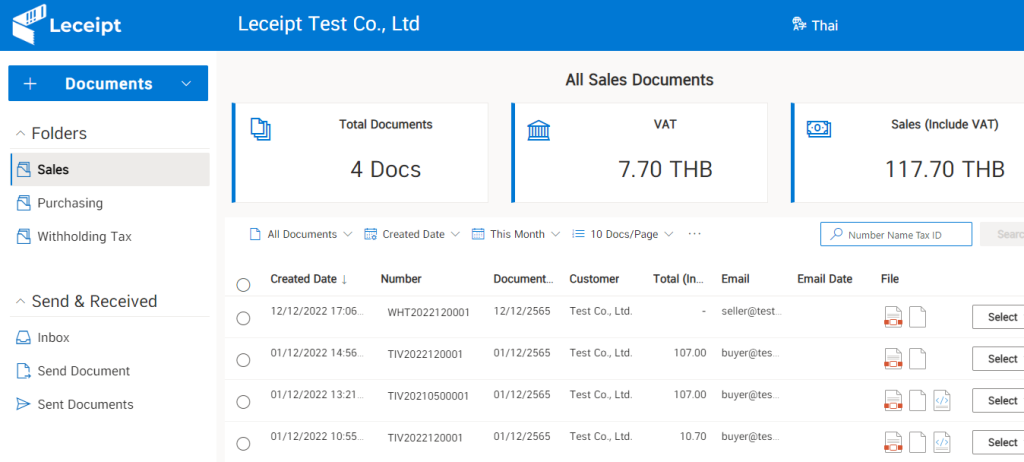

For our Leceipt system supports the generation of input tax reports. which has the following steps:

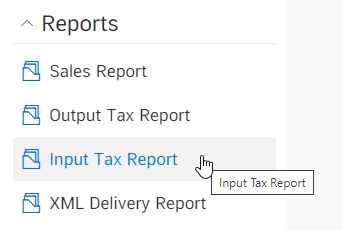

1. Go to page “Input Tax Report”

In the left-hand side of the menu will notice the topic (Report). Go to Input Tax Report

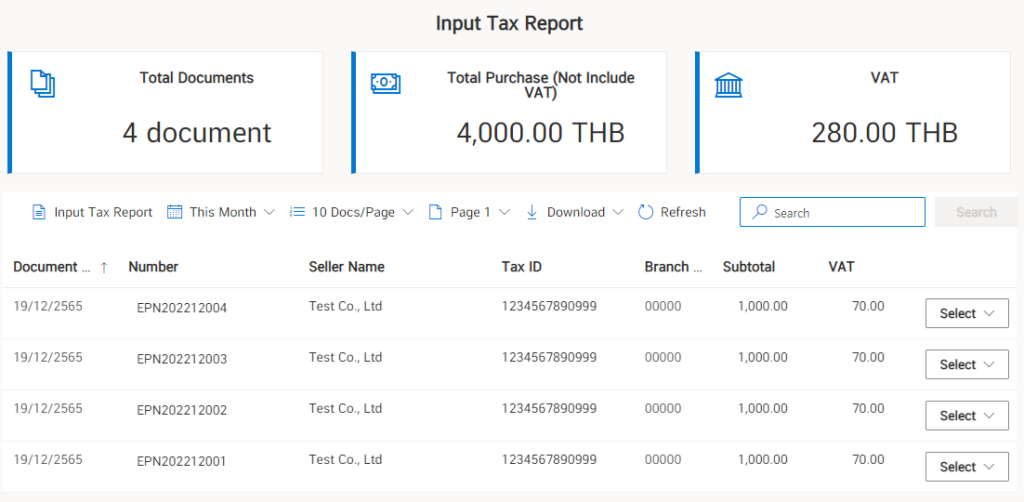

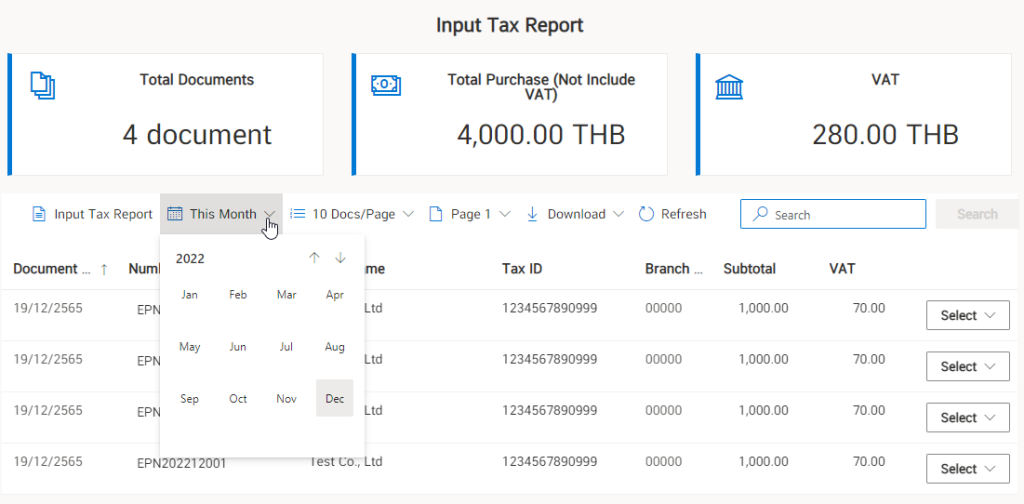

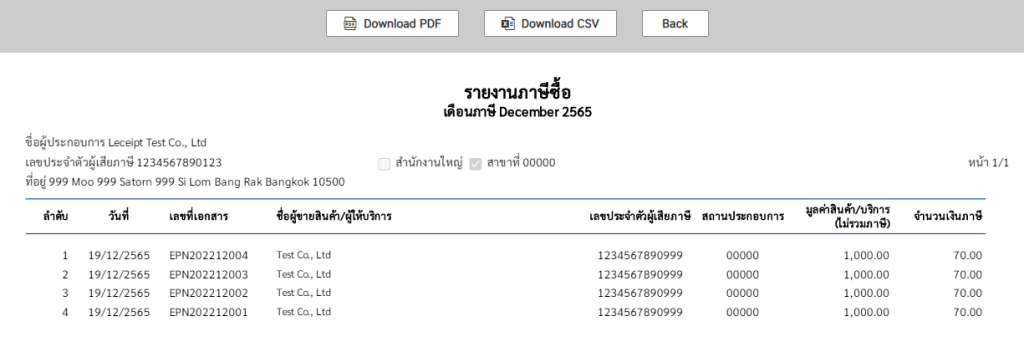

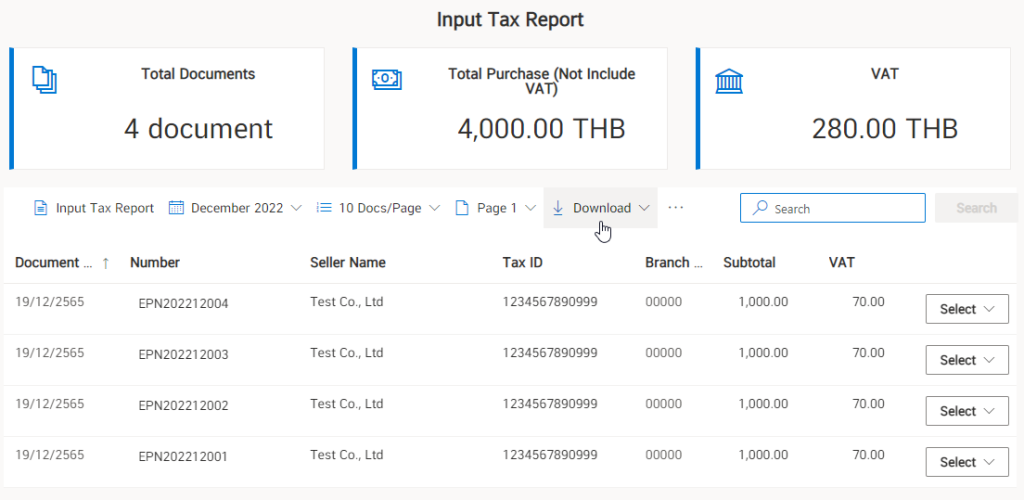

Then you will find a page that displays the information as shown in the picture.

2. Select the month that you want to generate the Input Tax Report

By selecting the month that you want to generate the input tax report. In the example, December is selected.

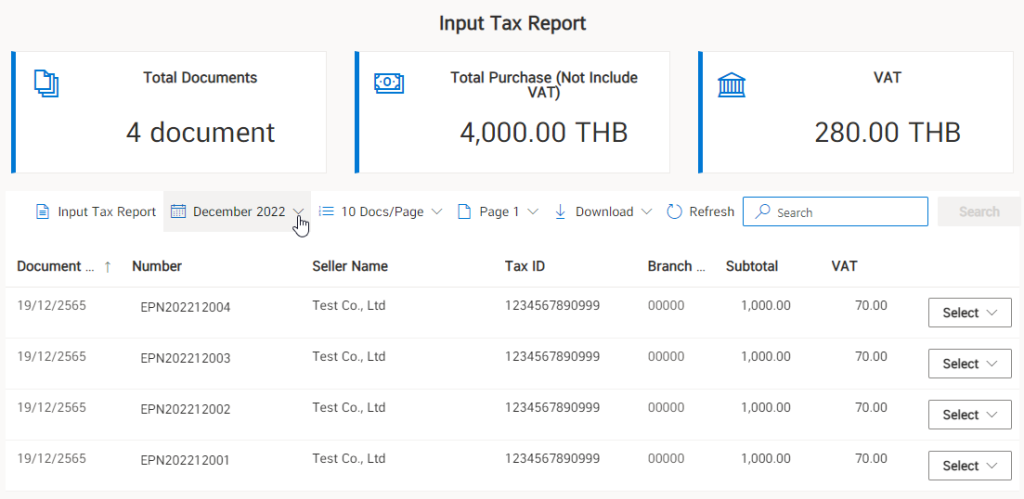

which will display information “Input Tax Report” of the expense record document for December as shown.

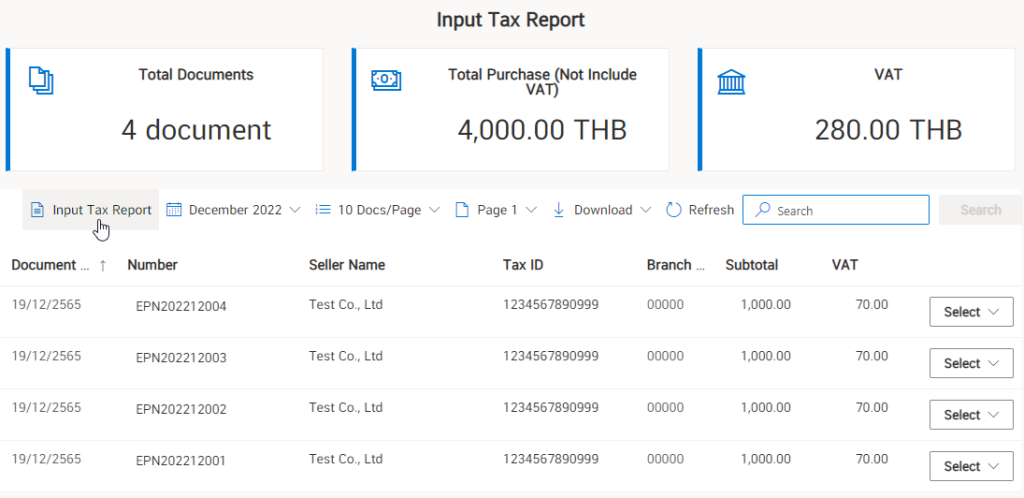

3. Example of Input Tax Report

Once the desired month has been selected, click Select Input Tax Report

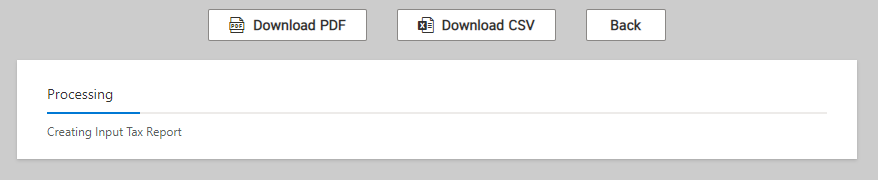

The system then processes it to create a document. Please wait a moment.

Then a sample input tax report is shown as shown.

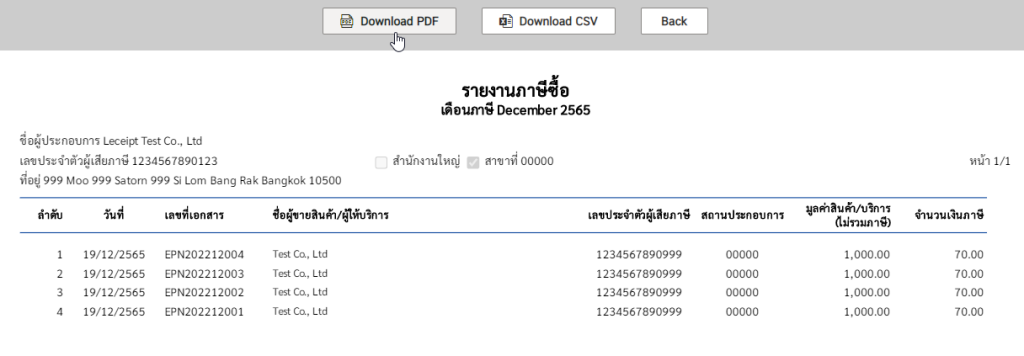

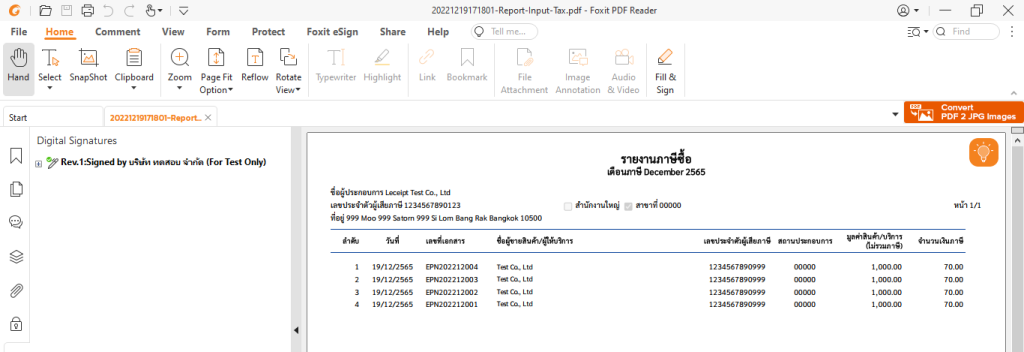

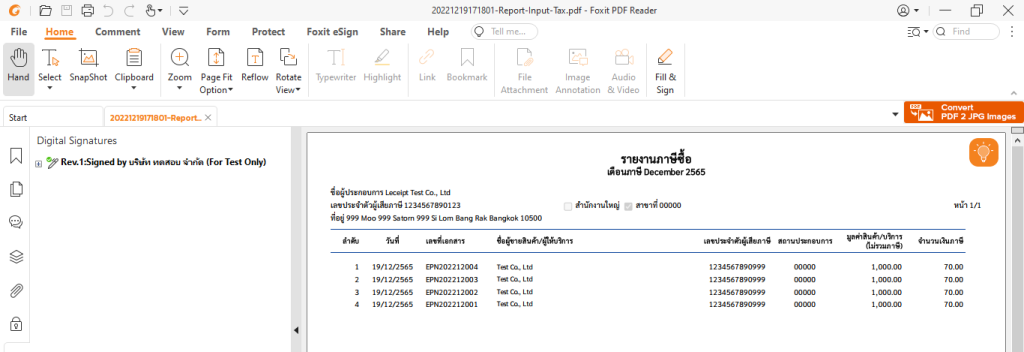

4. Download and open the PDF Input Tax Report

From item 3. Above, we can click on the PDF download button.

When downloading PDF documents to your computer. It is recommended to open the file with the program “Foxit PDF Reader”.

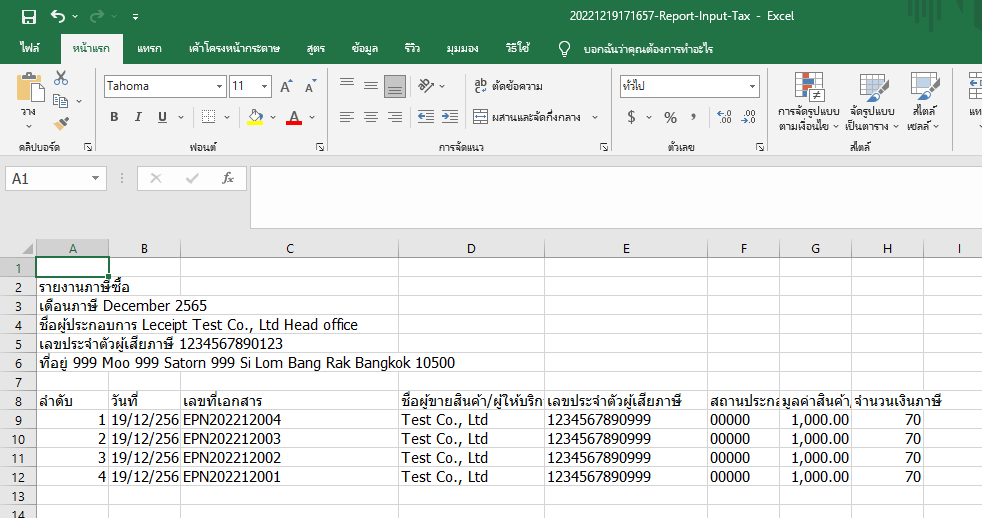

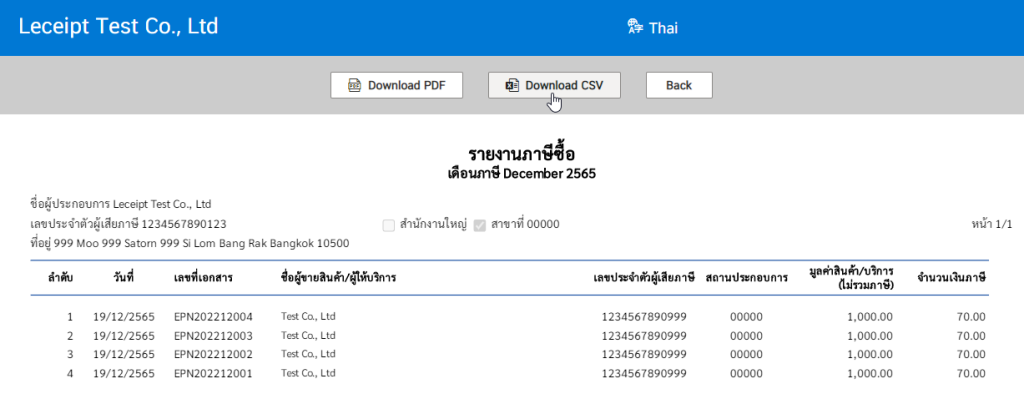

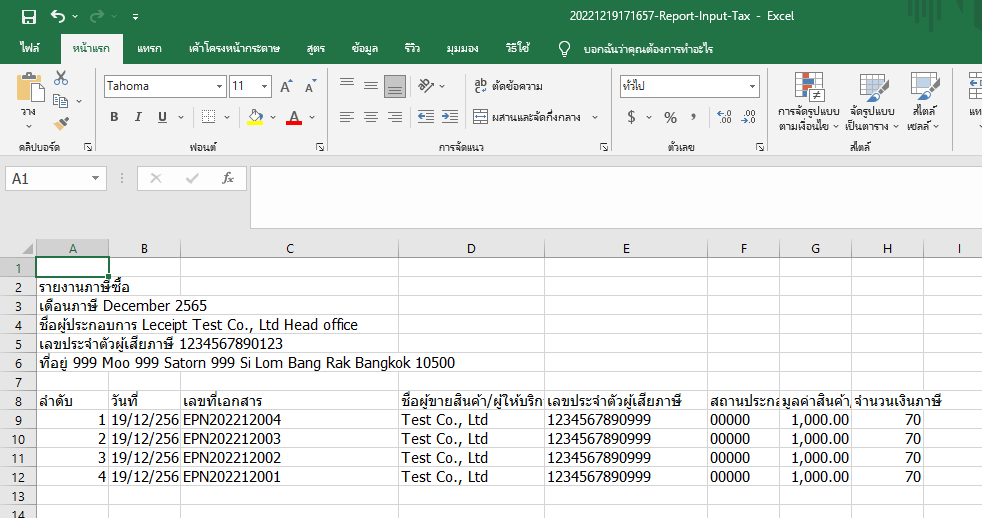

5. Download and open the CSV file of Input Tax Report

From item 3. Above, we can click on the CSV download button.

The downloaded file opened with Microsoft Excel will show the details of the document.

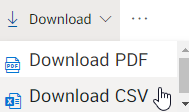

6. Direct download of Input Tax Report

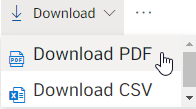

Click on the “Download” button.

You can choose to download PDF files by clicking on “Download PDF”.

Then wait a moment The system will display a message “Loading”.

When downloading PDF documents to your computer. It is recommended to open the file with the program “Foxit PDF Reader”.

You can choose to download the PDF file by clicking on “Download CSV”

The downloaded file opened with Microsoft Excel will show the details of the document.