Microsoft Excel Template to create e-Tax Invoice & e-Receipt documents

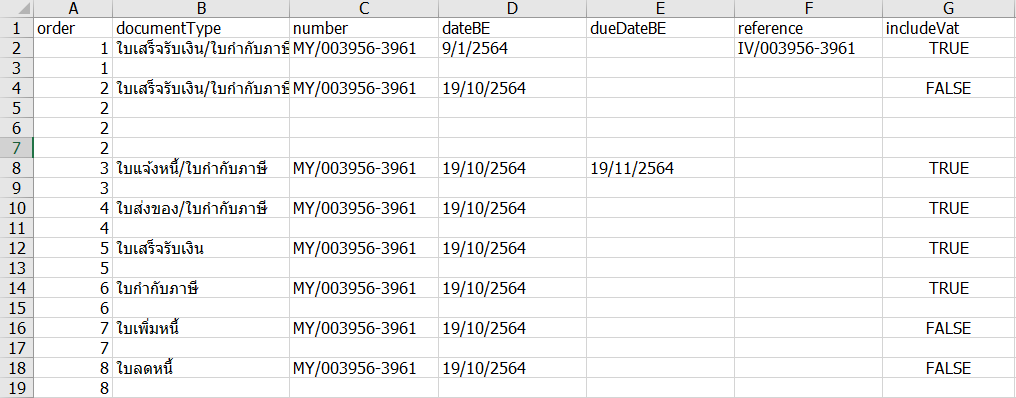

1. The input part of each column.

Each column is described as follows.

order: order

documentType: The order of the documents.

- e-Receipt/ e-Tax Invoice

- e-Invoice/e-Tax Invoice

- e-Delivery Invoice/e-Tax Invoice

- e-Tax Invoice

- e-Receipt/e-Abb tax invoice

- e-Receipt

- e-Debit note

- e-Credit note

- e-Quotation

- e-Invoice

- e-Bill

number : Document number.

dateBE : Day, Month, Year (B.E.) the document was issued.

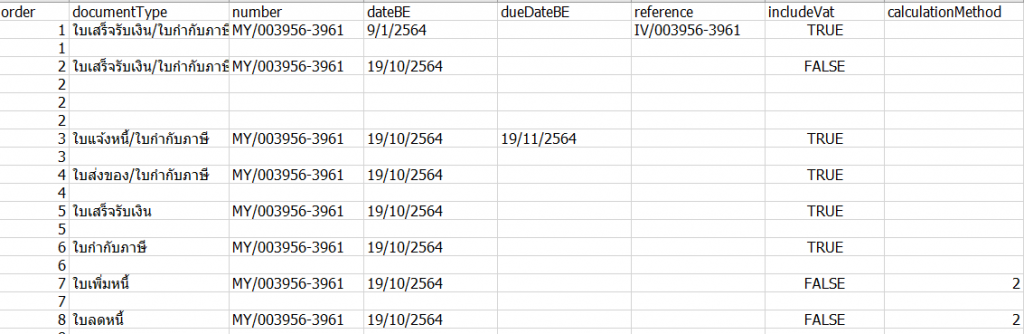

IncludeVat: Price includes VAT. If included, specify true .

(Only Quotation, Invoice, Billing) Pay via PromptPay. If yes, specify true

Only Debit note, Credit note) Specify as 1 = Debit note/Credit or 2 = Actual price.

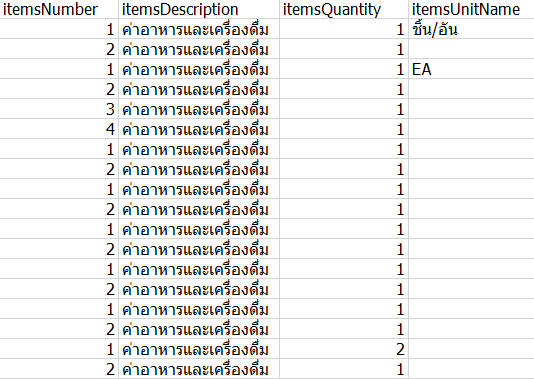

Specify a vertical list of products by using order to indicate which document the item is in. For example:

itemsNumber : The order of the items or services.

itemsDescription : A description of a product or service.

itemsQuantity : Number of items.

itemsUnitName : item unit information

| Unit (Thai language) | Unit (English) |

| – | – |

| ชิ้น/อัน | EA |

| กล่อง | BX |

| แพ็ค | PACK |

| หน่วย | AU |

| ถุง | BAG |

| ปิ๊ป | BKT |

| ขวด | BT |

| กระป๋อง | CAN |

| เซลล์ | CELL |

| วัน | DAY |

| ถัง | DR |

| โหล | DZ |

| แกลลอน | GLL |

| งาน | JOB |

| ชิ้น | PCS |

| ชุด | SET |

| เมตร | M |

| หลา | YARD |

| ซม. | CM |

| นิ้ว | INCH |

| กรัม | GRAM |

| กก. | KG |

| ปอนด์ | POUND |

| ลิตร | LITRE |

| เส้น | LINE |

| คัน | CAR |

| เที่ยว | TRIP |

| แผ่น | SHEET |

| ม้วน | ROLL |

Units can be typed into Thai or English unit names.

For example, if the product list is in boxes , type in boxes (type in Thai) or type in BX (for English).

An example of entering data is shown in the figure below.

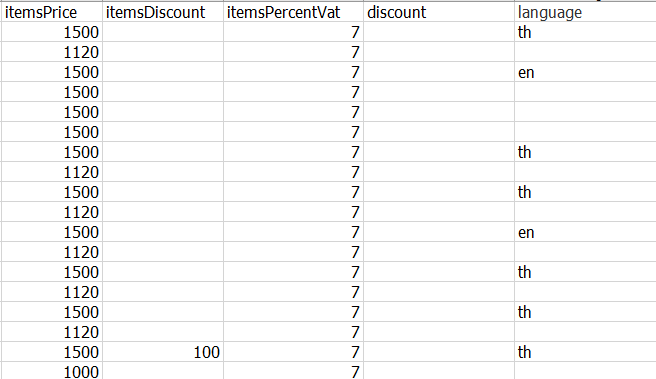

itemsPrice : The price of a product or service per unit.

itemsDiscount : Discount on goods or services per unit.

itemsPercentVat : The tax percentage of the item contains

- If it is a tax exempt item, specify – 1.

- If it is a 0% tax item, specify 0 .

- If it is a 7% tax item, specify 7.

discount : (Can be blank) total discount (different from items_discount ).

Language, if English, specify en , if Thai, specify th.

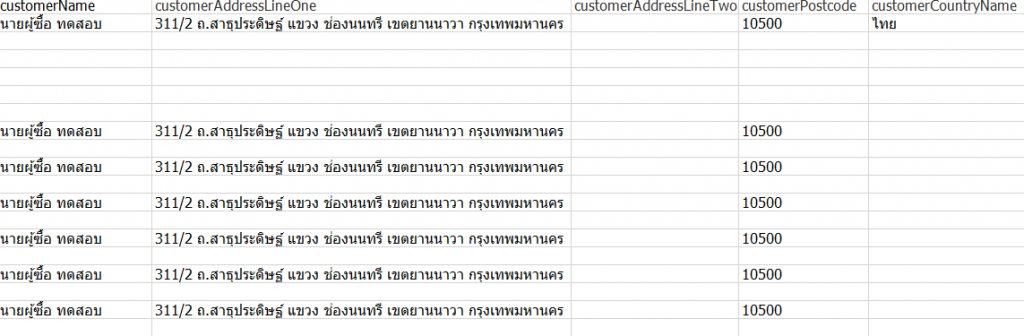

Buyer’s part

Note: If documentType is specified as RECEIPT-TAXINVOICE-ABB. (abbreviated tax invoice) is not required on the part of the buyer.

customerName : Buyer’s name or buyer’s company.

customerAddressLineOne : Buyer’s address or buyer’s company, line 1.

customerAddressLineTwo : (Can be blank) Buyer’s or buyer’s company address, line 2.

customerPostcode : Postal Code

customerCountryName : (You can leave blank) Country name such as Thailand (default) Click to view country name details.

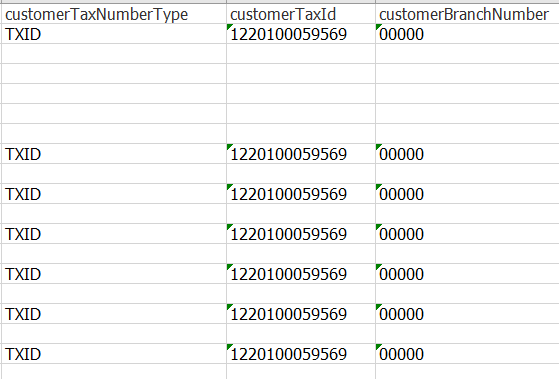

customerTaxNumberType : The taxpayer type code contains.

| Requirements in the file | Meaning |

| TXID | Tax Identification Number |

| NIDN | ID Number |

| CCPT | Passport Number |

| OTHR | Do not want to specify |

customerTaxId : Tax ID if

- customerTaxNumberType as TXID => Specified as a 13-digit corporate tax ID number.

- customerTaxNumberType as NIDN => Specified as a 13-digit identification number (for individuals).

- customerTaxNumberType as CCPT => Specified as Passport Number.

- customerTaxNumberType as OTHR => N/A

customerBranchNumber: Branch code, head office is 00000.

customerPhone : Phone number

customerEmail : Email

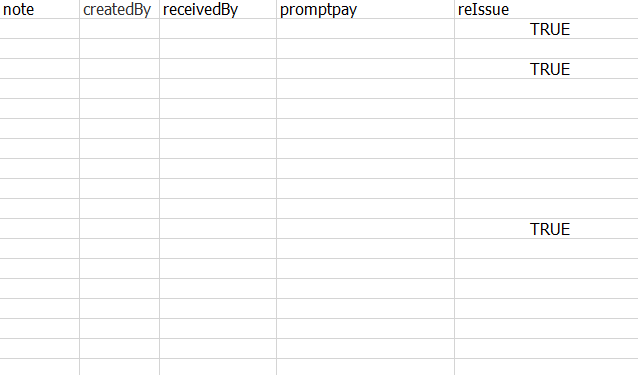

note : (You can leave blank) Note that you want to show in the e-Receipt/e-Tax invoice.

receivedBy : (Can leave blank) Name of payee.

createdBy : (Can leave blank) Author name.

reIssue : If a new tax invoice is issued in lieu of a canceled tax invoice, true.

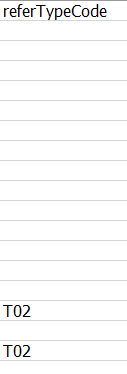

Part of the Document Referred to

Note: If reIssue is specified as false, no information is required here. except the documents of Debit note and credit note to be specified in this section.

referTypeCode : Reference document type code. (Include only document, debit note or credit note only).

| Requirements in the file | Meaning |

| T02 | e-Invoice/e-Tax Invoice |

| T03 | e-Receipt/e-Tax Invoice |

| T04 | e-Delivery invoice/e-Tax invoice |

| 388 | e-Tax invoice |

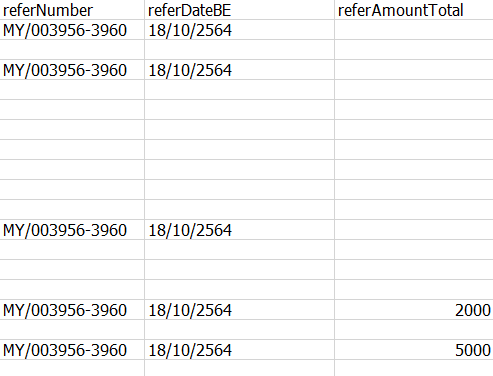

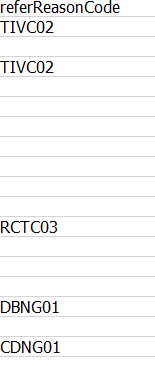

referNumber : The number that the document refers to.

referDateBE : Date, month, year (B.E.) the reference document was issued.

referAmountTotal : The value of the product or service according to the original document. (Include only document, debit note or credit note only).

referReasonCode :

For RECEIPT-TAXINVOICE, INVOICE-TAXINVOICE, DELIVERYORDER-TAXINVOICE, TAXINVOICE, RECEIPT-TAXINVOICE-ABB

| Requirements in the file | Meaning |

| TIVC01 | Wrong name |

| TIVC02 | Wrong address |

| TIVC99 (if specified, referSpecificReason must also be specified) | Other reasons |

For RECEIPT

| Requirements in the file | Meaning |

| RCTC01 | Wrong name |

| RCTC02 | Wrong address |

| RCTC03 (if specified, referSpecificReason must also be specified) | Return of goods/cancellation of service in full amount. |

| RCTC04 (if specified, referSpecificReason must also be specified) | Returns/cancellation of partial services. |

| RCTC99 (if specified, referSpecificReason must also be specified) | Other reasons |

For DEBIT-NOTE

| Requirements in the file | Meaning |

| DBNG01 | There is an increase in the price of the product. |

| DBNG02 | Miscalculated the price of a product that was lower than it actually was. |

| DBNG99 (if specified, referSpecificReason must also be specified) | Other reasons (in case of product price). |

| DBNS01 | There is an increase in the price of the service. |

| DBNS02 | Miscalculated the price of a service fee that is lower than it actually is. |

| DBNS99 (if specified, referSpecificReason must also be specified) | Other reasons (in case of service). |

For CREDIT-NOTE

| Requirements in the file | Meaning |

| CDNG01 | Reduce the price of the products sold. |

| CDNG02 | Damaged goods |

| CDNG03 | The product is out of quantity as agreed upon. |

| CDNG04 | The price was calculated wrongly higher than it actually was. |

| CDNG05 | Return |

| CDNG99 (if specified, referSpecificReason must also be specified) | Other reasons (in case of selling products). |

| CDNS01 | service fee reduction. |

| CDNS02 | Lack of service charge. |

| CDNS03 | Miscalculated the price of the service fee higher than it actually is. |

| CDNS04 | service contract termination. |

| CDNS99 (if specified, referSpecificReason must also be specified) | Other reasons (in case of service). |

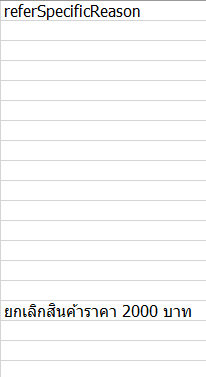

referSpecificReason : If the cause is other must state the reason.

If referSpecificReason specifies as RCTC03 => specifies as Return or Cancel service, the whole amount followed by the amount number. Place a space between the text and the number. Example: Return the entire product for 2000 baht.

If referSpecificReason specifies as RCTC04 => specifies as Refund or Cancel service, the whole amount followed by the amount number. Place a space between the text and the number. Example: Return the entire product for 2000 baht.

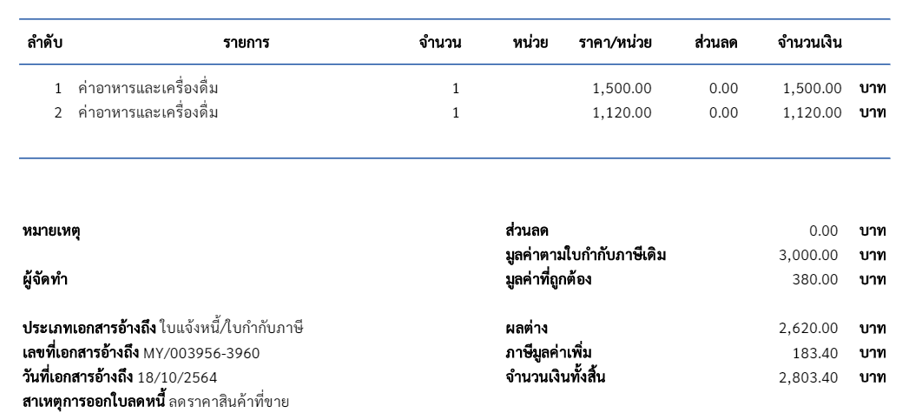

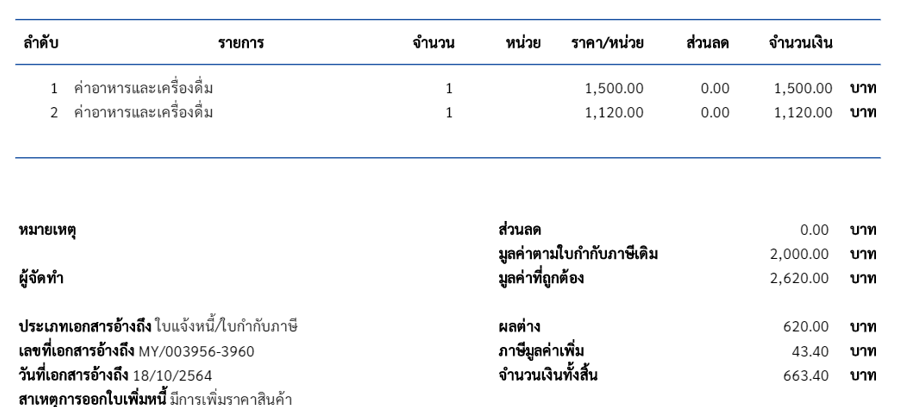

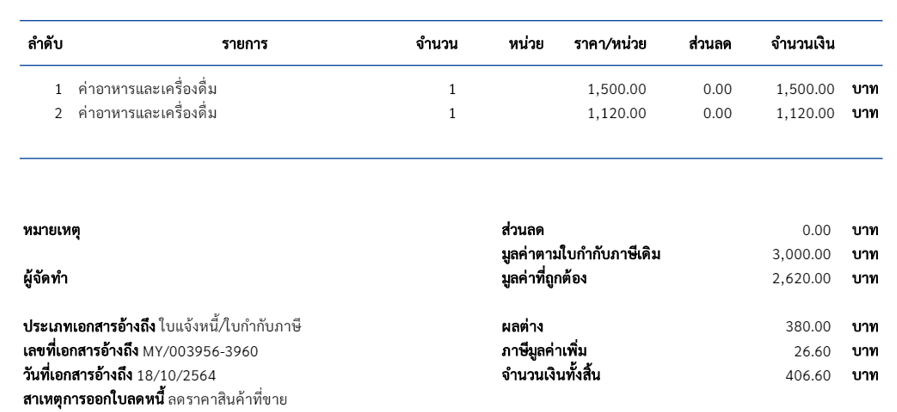

calculationMethod

Calculating debit note and credit note divided into two types.

Type 1 (Debit note)

Type 1 (Debit note)

Type 2 (Debit note)

Type 2 (Debit note)

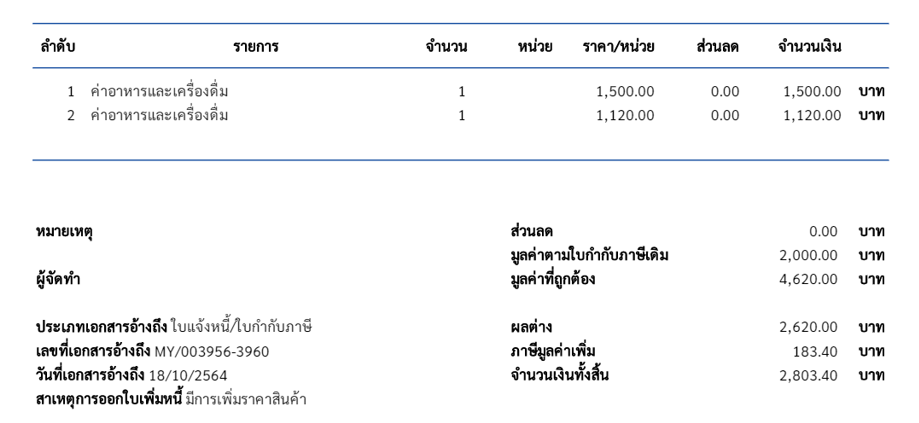

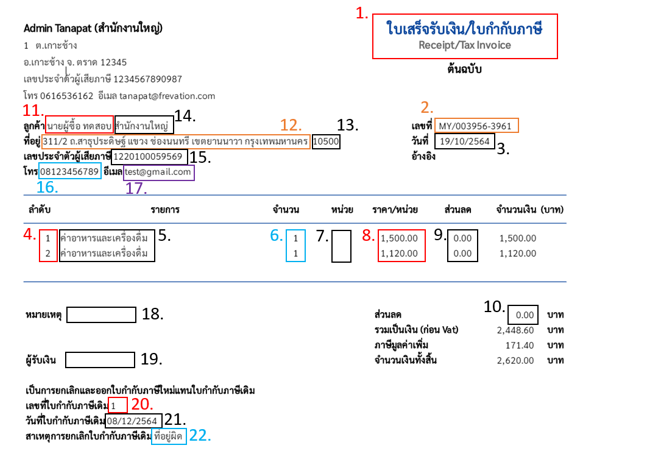

2. Examples of Excel columns compared to actual documents

The column names in the Excel document are shown below referring to the numbers as shown below.

- documentType

- number

- dateBE

- itemsNumber

- itemsDescription

- itemsQuantity

- itemsUnitCode

- itemsPrice

- itemsDiscount

- discount

- customerName

- customerAddressLineOne + customerAddressLineTwo

- customerPostcode

- customerBranchNumber

- customerTaxId

- customerPhone

- customerEmail

- note

- createdBy, receivedBy

- referNumber

- referDateBE

- referReasonCode