Verify e-Tax Invoice & e-Receipt

If you received the e-Tax Invoice & e-Receipt document from a seller of a goods or service

Step to use Leceipt (e-Tax Invoice & e-Receipt)

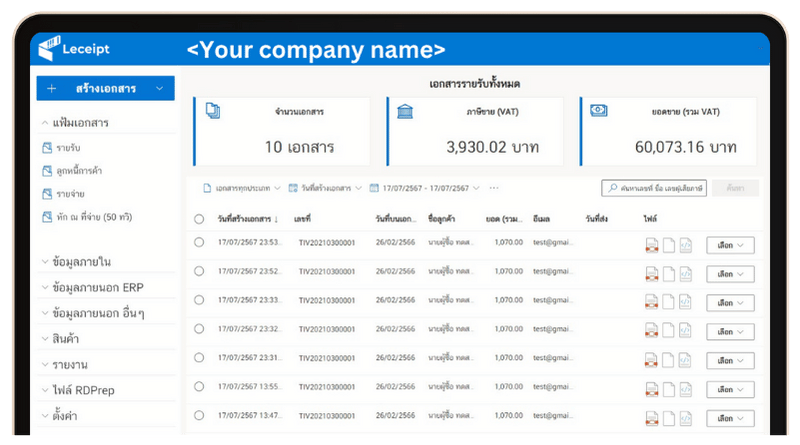

Leceipt System

is an electronic document preparation system to help your business that be able to generate electronic documents instead of paper documents, reduce both shipping costs and duration to delivering documents to customers, and include reduce the cost of developing your own software, which customers will receive a document as PDF/A-3 files

If your company has a system to sell products online. Previously, the documents had to be sent by post. You can switch to electronic delivery of documents immediately after the customer paid, which reduce both papperwork and shipping costs

If interested, you can contact our customer service at+66 (0)82-579-8555 to consult

or request to connect to the system via API

How to use

The Leceipt system can be use online through web browser. No need software installation requiredCompatible with all computer system

Compatible with the e-Tax Invoice & e-Receipt of the Revenue Deparment. log-in here

(In the initial use can be used both with electronic documents and in term of paper documents)

Create any e-Tax document

(PDF/A-3 file, XML) file

- Receipt / Tax Invoice

- Receipt / ABB Tax Invoice

- Receipt

- Invoice / Tax Invoice

- Delivery Order / Tax Invoice

- Tax Invoice

- Debit Note

- Credit Note

PDF/A-3 XML

format

PDF/A-3 file

Use for sent to your customer

XML file

Use for sent to The Revenue Department

Full Services

Electronic certificate request service.

Support files storage device.

Support registration services e-Tax Invoice & e-Receipt form with the Ultimate Sign & Viewer.

There is an API to connect to.

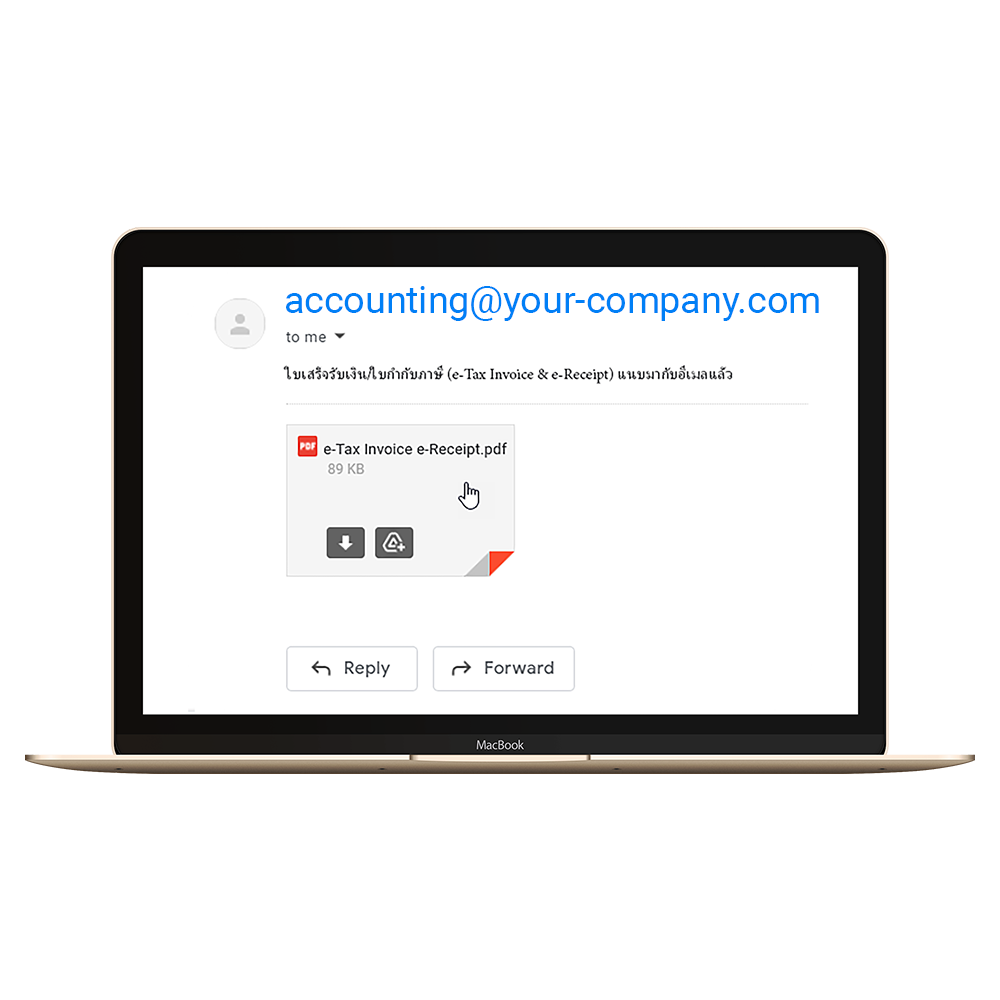

Instantly send emails from Leceipt.

The recipient will see that it was sent from

"Your company"

The software of

e-Tax Invoice & e-Receipt

according to The Revenue Department

- ETDA Recommendation on ICT Standard for Electronic Transactions TRADE SERVICES MESSAGE STANDARD

- ETDA Recommendation on ICT Starndard for Electronic Transactions USING XML MESSAGE FOR INTER-ORGANIZATIONAL DATA EXCHANGE

- ETDA Recommendation on ICT Starndard for Electronic Transaction ELECTRONIC CERTIFICATE

Read on for a bit for save your money

If you are looking for e-Tax Invoice & e-Receipt software. Plase choose the software first. Don't be in a rush to buy an eToken and go buy an electronic certificate. Because the data aleady installed into the eToken cannot be removed.

Many customers who want to use the Leceipt system but have already bought eTokens and certificates. A new certificate must be requested because the old one cannot be removed from the eToken, as this is to secure data from being copied from the eToken

Our company has an electronic certificate and electronic certificate files storage device.

Use the sevice here, you can save 3,000 Bath for eToken, and still get free! for lifetime electronic certificate storage device (limited quanlity)

Krit Sukavachana

CEO / Founder

"Our mission is to simplify process to make electronic documents."